This is a sponsored post for SheSpeaks and Prudential.

A unique virtual reality truck recently pulled into Copley Square in Boston, thanks to the Alliance for Lifetime Income. Anyone who walked up to the truck got to engage with displays designed to give them a glimpse into their future and feel what it’s like to take risks. What does it feel like to drive a racecar when you’re not experienced? How close does the virtual reality of swimming with sharks compare to the risk of swimming with them in real life? My fellow TV mom and blogger, Rene Syler from Good Enough Mother, gave these virtual reality experiences a spin.

Visitors also had the chance to try on the MIT Age Lab-designed suit named “Agnes”, designed so they could to feel 20 to 30 years older. With age comes a heavier body, achy joints and less than 20/20 vision.

If we’re lucky to live long enough, these physical hurdles will become our reality in the future. So will the reality of wondering if we have enough money saved for retirement to cover the costs of housing, utilities, medical care and other basics.

Together, these experiences showed me that “Risk + Age = The Need for a Reliable, Steady Retirement Plan.”

The Alliance for Lifetime Income, of which Prudential is a founding member, made this even clearer with the message on the virtual reality truck “Protect Your Income, Retire Your Risk.”

Since women live longer than men by an average of 5-6 years1, statistically make less money than men2 and often start saving for retirement later, we need to ask ourselves: How can I have a steady, guaranteed paycheck for life when I retire?

I learned from Prudential that an annuity can help! Annuities can provide a safeguard when the market stumbles, and an income stream you can count on.

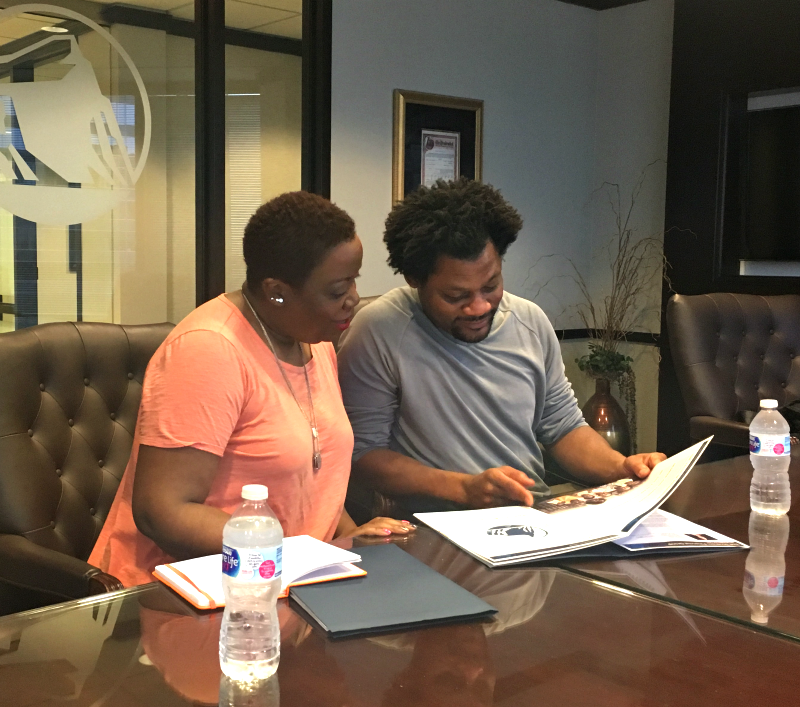

You may recall my husband and I have been going deeper into our finances and making plans for our future. I shared step-by-step How We Prepared to Meet with a Prudential Financial Professional. Here’s how you can set up a complimentary meeting with a Prudential financial professional where you live. You’re welcome to ask how annuities work to provide a consistent source of income in retirement, regardless of market changes. Get familiar with annuities and how they work before your conversation.

Comment below: Do you feel confident about your retirement plan? How often do you and your spouse discuss saving money and planning for retirement?

1Prudential Retirement analysis; National Center for Health Statistics, Health, United States, 2015: With Special Feature on Racial and Ethnic Health Disparities. Hyattsville, MD. 2016;

2U.S. Census Bureau, Historical Income Tables Table P-40: Women’s Earnings as a Percentage of Men’s Earnings by Race and Hispanic Origin, 2016

Mommy Talk Show Candid Conversation with a TV Mom

Mommy Talk Show Candid Conversation with a TV Mom

I’m feeling pretty good about ours. We just met with our Financial Planner this week!

There are definitely some changes I want to make to my retirement plan. As I get older, I want to be more secure in my finances so that I will be able to retire and still enjoy life without pinching pennies. I think it’s so great that in this day and age we have so many resources available to help us better navigate being financially responsible and stable.

Meeting with a financialplanner for the 1st time in January. Other than insureance and a very small Roth IRA, my retirement plan is not a “plan.” It’s definitely on my list of must-do’s for 1st quarter 2019.

I need to meet with my financial planner to ask more questions but for now I have something put away but I know it’s not enough. I want to be able to live when I’m in my 60’s without worry.

I love that you are shedding light on this. I don’t have one, tsk tsk I know, but I think I’m going to start one in the new year. Thanks for the reminder!

This is great information that every woman/family needs. My spouse and I are n the process of making some changes now to ours so this post was timely!

Such an important post! I am so guilty of thinking retirement is SO far away that I don’t really need to know what’s happening. But we should all be aware of our policies and where we stand.

I was just literally talking to my partner about what to do for my retirement plan in the future since I am a freelancer. I know it may seem like a long time away for me since I am in my early 30s, but the earlier the better to get my nest egg started.

Seeing what my parents are doing now gives me a glimpse of retirement, and they planned well. But time goes so fast that I really need to set up some things ahead of time to make sure everything is good! This is a cool experience!

Wow, I never thought about half the stuff you shared with us. Thank you for the knowledge. I must do so more research.

I must admit, I haven’t thought about all of the details for my retirement. This was helpful. Thank you for unveiling the mask of what could be an overwhelming topic.

Looks like a very fun, hands-on exhibit that packs a reality punch. Such good advice Joyce! After about 6 years with a male financial advisor that I just didn’t click with I changed and brought my money to a woman financial advisor whom I adore! I think not only do you have to feel secure where you are putting your money but secure with the person who is advising you.

This is a great and informative post! It makes me realize I need to be more knowledgeable about my retirement plan. To be honest, I have one set up through my job, but I mainly just have my father read it all and summarize it for me.

Great blog post because so many single women aren’t up on annuities and why they need a smart retirement plan. Thanks so much, Brenda

I have to get on the ball with this! I hadn’t started thinking that I need to get started earlier because my husband is statistically probably not going to be here as long as I am. I mean, I knew it, but hadn’t put it together with retirement planning.

Choosing a financial advisor is such a important decision. Thank you for this timely information. This reminded me to do the adjustments as soon as January.

I am so in this space right now. I always thought retirement was for people who were near retirement age. A few years ago I realized that I need to start planning now, so I can have the life I want when I’m ready for retirement. I want to make sure I can continue to live my best life post retirement.

Such an important post! I was actually just on the phone with my financial advisor. I’m going to be armed with this good info and educating myself more about annuities.

This is a great post. It addresses a topic that definitely needs to be discussed. I’m far from retirement but this has me thinking and beginning to prepare.

Definitely have a good plan with my partner outside of our regular benefits. This post opened my eyes though. We might need additional protection

I use to work for Lincoln Financial planning for retirement is so important. I have a financial planner through USAA

I think about retirement every day. All I want to do is retire but I also know that thinking about it and actually being able to are two different things. As an older mom, I have had to think about realistically how or is it even possible to retire while my kids are in college. I do have a retirement that I contribute to at my job and my organization contributes too. And I have an IRA that I rolled over some of my plans from other institutions. I haven’t been able to contribute to it yet because I am in the process of paying off debt. These are my plans and I hope to stick with it.

I agree that you do need to consider a lot of factors such as age and risk when considering investments. I don’t know too much about annuities, so this post was helpful.

I take for granted that my retirement account is running in the background through my employer. I need to take charge and be aware of the details.

Lots of great information! I’ll definitely be looking into annuities now!

I learned a lot from this post. I haven’t really thought about retirement yet and this made my realize I need to get serious about planning and have a talk with my husband.

My husband is a self employed farmer and I help him out. We have money in retirement savings with a financial planner.

This is a very informative post. We definitely need to go over our retirement plans again and update.

It is important to keep track of retirement funds and ask questions about this subject.

I do not feel confident in my retirement plan. It is much more difficult when you don’t have a spouse’s income to help.

Thank you for the tips. I am getting close to retirement soon.

This very question is why I am trying to find a job so I can save up and have a steady income.

Wow… the virtual-reality truck looks incredible, and seems like a wonderful resource for education.

Re: the two questions posed at the end of this post, I do not feel comfortable responding as I am not in a good place right now. I hope that you understand.

The helpful retirement tips and meeting with a planner are informative to look into.

I’m a stay at home Mom but hibby is accruing a decent sized 401k so far. I just know we could be making so much more off of it thru investments etc but we really need to sit down with a financial counselor & figure out a plan. Only problem is, hubby’s job just shut down so now we’re afraid of any financial moves.

Reviewing retirement options especially as women is so important. Thank you for this article!

I have not even thought about my retirement plan, but something to look into for sure. Great tips this is so important for our generation.

We’ve just recently started talking about our retirement plans and that we should be booking an appointment with a financial advisor soon to make our dreams a reality. Thanks for thus great read

I am not completely prepared but getting close to that time so I have to get my act together.

Honestly something me and husband was just talking about! NEVER to early to start.

Sounds like fantastic advice for us ladies. Will definitely be sharing your post with some friends. Thanks!

I shared this post with my mom who is almost at retirement age. Very helpful.

There is so much good information here! I’m still many years away from retirement but it’s definitely not something that you want to wait on!

Very informative article! My husband and I have met with a financial planner and have a plan in place for retirement!